A Step-by-Step Guide to Setting Up an Efficient Bookkeeping System for Small Businesses

A step-by-step guide to organizing financial records, tracking expenses, and maintaining accurate books for small business success.

FINANCIAL SERVICES

4/30/20258 min read

Understanding the Importance of Bookkeeping

Bookkeeping serves as the backbone of any small business, playing a critical role in its overall management and operational success. Accurate financial records facilitate informed decision-making, allowing business owners to monitor their cash flow and assess the health of their enterprise in real-time. By maintaining meticulous bookkeeping practices, small businesses can derive insights into their revenue streams, expenses, and profitability, thereby identifying trends that could influence future strategies.

When a small business implements an efficient bookkeeping system, it establishes a solid foundation for financial planning. It aids in budgeting, predicting future cash flows, and assessing financial performance against set benchmarks. Moreover, a transparent financial record fosters trust between business owners and stakeholders, including investors, customers, and suppliers, enhancing business credibility and facilitating potential partnerships.

Conversely, poor bookkeeping practices can adversely affect a small business. Inaccurate financial records may lead to poor financial decisions, such as overspending or misallocating resources. Businesses that fail to keep up with their bookkeeping can encounter cash flow problems, making it difficult to pay bills or invest in growth opportunities. Furthermore, inaccuracies in financial reporting can result in tax penalties or legal complications, which may hinder a business's long-term viability.

Consequently, small businesses must recognize the significance of adopting robust bookkeeping methods. This includes regularly updating financial records, reconciling bank statements, and utilizing financial software tailored to their specific needs. By prioritizing accurate bookkeeping, small businesses not only streamline their financial processes but also position themselves for sustainable growth and success in an ever-evolving marketplace.

Choosing the Right Bookkeeping Method

Selecting an appropriate bookkeeping method is fundamental for small businesses aiming to maintain financial accuracy and efficiency. The two primary bookkeeping methods are single-entry and double-entry systems, and each possesses distinct characteristics suited to varying business needs. The single-entry system is generally simpler and ideal for smaller businesses with uncomplicated transactions. It involves recording each transaction once, either as income or an expense, making it a straightforward choice for businesses with limited financial complexity.

In contrast, the double-entry bookkeeping method offers a more comprehensive approach. This system requires that every transaction be recorded in at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. The double-entry method is particularly beneficial for larger businesses or those with more complex financial activities. This approach not only aids in accurate financial tracking but also enables better financial analysis, which can be advantageous for decision-making processes.

Another aspect to consider when choosing a bookkeeping method is the option of manual bookkeeping versus computerized systems. Manual bookkeeping can be a cost-effective solution for small businesses just starting or those with relatively few transactions. However, as a business grows, the complexity of manual tracking can lead to inefficiencies and increased chances of errors. Therefore, many small businesses opt for bookkeeping software, which can automate processes, streamline data entry, and enhance accuracy. Software solutions often come equipped with features like invoicing, expense tracking, and reporting tools that significantly benefit business operations.

Ultimately, the choice between single-entry and double-entry methods and between manual and software-driven bookkeeping should align with the specific needs, size, and nature of a small business. Assessing these factors carefully will facilitate a bookkeeping system that supports long-term success and operational efficiency.

Setting Up a Chart of Accounts

A chart of accounts (COA) serves as a crucial component of any financial management system, particularly for small businesses. It is essentially a structured list that categorizes every financial transaction made by the company. This classification system ensures that all financial records are organized efficiently, which aids in monitoring financial performance, preparing financial statements, and fulfilling compliance requirements. A well-structured chart of accounts can significantly enhance the ease with which financial data can be analyzed and interpreted.

To create a customized chart of accounts for your business, you need to begin by considering the unique aspects of your operations. Start with broad categories that cover the essential financial aspects: assets, liabilities, income, and expenses. For instance, within the asset category, you might include accounts such as cash, accounts receivable, and inventory. Each of these subcategories will allow for a deeper understanding of the company’s financial position.

Next, in the liabilities category, you may list accounts like accounts payable and loans payable, which help in tracking what your business owes. In terms of income, create accounts for different revenue streams—perhaps sales revenue, service income, or interest income—based on the nature of your business operations. Expenses should be categorized as well, with accounts for operating expenses, payroll expenses, and marketing expenses, among others. This delineation not only simplifies bookkeeping but also aids in financial reporting and budgeting processes.

As you set up your chart of accounts, consider consulting industry standards or examples from similar businesses. This can provide insights on how to best structure your accounts for clarity and efficiency. In addition, keep your chart of accounts flexible to adapt to any changes in your business operations over time.

Tracking Income and Expenses

Effective tracking of income and expenses is a cornerstone of a robust bookkeeping system for small businesses. By maintaining accurate records, business owners can gain invaluable insights into their financial performance and make informed decisions. One of the essential practices in this domain is the timely recording of transactions. Each sale, receipt, or payment made should be documented immediately to prevent discrepancies and lapses in financial data.

To streamline the process of recording transactions, consider using a reliable accounting method such as cash basis or accrual accounting. The cash basis method involves recording income and expenses when they are actually received or paid, while the accrual method recognizes these when they are incurred. Choosing the right approach depends on the specific needs of the business and can affect tax reporting as well.

Managing receipts is another critical aspect of tracking financial activities. It is advisable to maintain a systematic filing system for receipts, which could be physical or digital. Digital expense tracking tools allow for automated receipt scanning and categorization, thus reducing the clutter and simplifying audits. Implementing an organized system enables business owners to retrieve records easily, especially during tax season.

Furthermore, categorizing expenses accurately can enhance visibility into spending patterns. By grouping costs into relevant categories—such as office supplies, travel expenses, and utilities—businesses can better understand where their money is going and identify areas for potential savings. Utilizing tools and software designed for bookkeeping can automate much of this categorization, allowing for real-time tracking of financial transactions with minimal manual input.

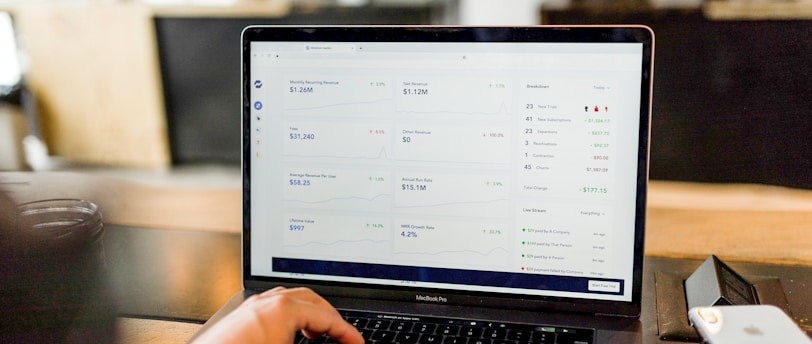

There are many software options available, such as QuickBooks, Xero, and FreshBooks, that can aid in tracking income and expenses effectively. These tools not only facilitate regular updates to financial records but also generate reports that provide insights into profitability and expenditure trends. Leveraging technology in this manner allows small business owners to focus more on their core activities while ensuring accurate financial management.

Maintaining Accurate Financial Records

Maintaining accurate financial records is paramount for small businesses, as it lays the foundation for effective decision-making and financial health. Accurate financial records provide clear insights into a company’s performance, enabling business owners to assess profitability, manage cash flow, and identify areas for improvement. Therefore, establishing a rigorous bookkeeping system is critical.

One of the key practices for ensuring accuracy in financial records is the regular reconciliation of accounts. This involves comparing the internal records of the business with external statements, such as bank statements or credit card transactions. By regularly reconciling these accounts, business owners can swiftly identify discrepancies that may arise from errors or fraudulent activity. It is advisable to conduct this reconciliation on a monthly basis to ensure any issues are addressed promptly and to maintain confidence in the financial standing of the business.

When discrepancies occur, prompt investigation is crucial. Business owners should develop a standardized process for addressing these discrepancies, which includes reviewing supporting documents and possibly adjusting records accordingly. It is also beneficial to implement internal controls that can help mitigate the likelihood of discrepancies occurring in the first place, such as segregation of duties in financial processing and regular internal audits.

Additionally, organized document management contributes significantly to maintaining accurate financial records. Business owners should develop a system for categorizing, storing, and retrieving documents, particularly receipts, invoices, and bank statements. Whether adopting a digital system or maintaining physical files, ensuring that documents are systematically organized will facilitate easier access and corroborate the financial transactions recorded.

Lastly, timely updates to the bookkeeping system are essential for maintaining accurate financial records. Regularly entering transactions, noting expenses, and updating any changes ensures that the system reflects the current state of the business. This habit also provides a real-time overview of the business's financial health, allowing for informed strategic decisions.

Preparing for Taxes and Compliance

Preparing for the tax season is a critical aspect of maintaining an efficient bookkeeping system for small businesses. An organized approach not only facilitates compliance with financial regulations but also ensures that businesses can accurately report their income and expenses. One of the first steps in this process is to understand which records need to be kept for tax purposes. Essential documents include income statements, expense receipts, payroll records, tax returns from previous years, and any correspondence with tax authorities. Maintaining these records in an orderly fashion aids in quick access during tax preparation.

Moreover, familiarity with local tax regulations is paramount. Different jurisdictions may have varying compliance requirements, including deadlines for tax submission, specific deductions available, and any special taxes that may apply to your business. It is advisable for small business owners to remain updated on changes that can affect their tax obligations. This can be achieved through regular reviews of local tax authority publications or engaging with professional tax advisors who specialize in small business compliance.

An organized bookkeeping system significantly simplifies the tax preparation process. By keeping accurate and up-to-date records throughout the year, small businesses can avoid the last-minute stress that often accompanies tax season. Digital tools and software designed for bookkeeping can expedite record-keeping, ensuring that all financial transactions are tracked efficiently. Such systems often feature automated reporting functions that prepare necessary documents in a format suitable for submission to tax authorities.

Lastly, consulting a tax professional can be a wise investment. Tax experts can provide valuable insights on compliance, potential deductions, and strategies to minimize tax liabilities. They can also assist in preparing tax returns, further alleviating the burden on small business owners during a typically hectic time.

Regular Review and Adjustment of the Bookkeeping System

To maintain an efficient bookkeeping system that adapts to the evolving needs of your small business, regular reviews and adjustments are essential. Over time, the dynamics of your business may change due to factors such as growth, technological advancements, or shifts in regulations. Therefore, proactively assessing your bookkeeping practices helps ensure that they remain effective and aligned with organizational goals.

A systematic approach to reviewing the bookkeeping system involves not only evaluating financial data but also analyzing the processes in place. Small businesses should schedule periodic assessments, ideally monthly or quarterly, to measure the accuracy of financial records, monitor performance indicators, and identify areas for improvement. This reflection can reveal discrepancies, enhance financial forecasting, and ultimately improve decision-making.

When discrepancies or inefficiencies are identified, adjustments should follow promptly. This can include refining workflows, upgrading accounting software, or even retraining staff on best practices. For example, if your bookkeeping software is unable to keep up with the volume of transactions or lacks important features, it might be time to consider a different solution that better fits your business's demands.

Staying updated on changes in regulations and tax laws is another critical aspect of maintaining an efficient bookkeeping system. As rules and regulations can evolve, especially in a business environment facing continual change, ensuring that your bookkeeping practices comply with current standards is paramount. Therefore, allocate resources for ongoing training, whether through workshops or online courses, to keep your team well-informed and prepared to address any new accounting requirements.

In summary, regular review and adjustment of your bookkeeping system enhances its overall effectiveness and efficiency. By adopting a proactive approach and continuously investing in staff training and resource updates, small businesses can achieve a robust bookkeeping system that accommodates growth and adapts to an ever-changing economic landscape.